Are You Better Off Under the New Federal Income Tax Rules?

Posted by J.R. Robinson April 2018

The Tax Cut And Jobs Act of 2018 was signed into law last December amidst a sea of political rhetoric. From the GOP perspective, it was framed as the largest tax cut since the Reagan administration and a boon for lower and middle-income Americans. This view was in stark contrast to that of the Dems, whose leadership decried the Act as a deficit-ballooning, tax cut for the rich. So, who’s right?

This article provides insight into how individual taxpayers may fare in 2018 under the TCJA relative to how much they paid to Uncle Sam under the 2017 federal income tax code.

The Tax Cut and Jobs Act of 2018 ushered in major changes to the federal tax code. Although the changes to the corporate tax structure were arguably the most impactful, the new law included major revisions to the tax code for individual filers as well. The most significant of these changes - or at least the ones most emphasized by the authors of the legislation (and the President) – are the near doubling of the standard deduction for married and individual taxpayers and across the board reductions in marginal tax brackets. With respect to the former, one of the President’s stated objectives of tax reform was a simplification of the code. To a degree, the increase in the standard deduction achieved this objective, as it is estimated that the percentage of taxpayers who itemize their deductions will fall from approximately 30% in 2017 to just 10% in 2018 (Source: AARP).

However, simplification does not necessarily equate to savings, and the questions that most taxpayers, including Financial Planning Hawaii clients, want answered is, “Who benefits the most from the new rules?” and, more importantly, “How much will I save?” Perhaps not surprisingly, the answers to these questions are not quite as straightforward as we might hope. This article seeks to sort through the political rhetoric surrounding the TDJA and to add clarity regarding how the new rules may impact you.

We begin by examining the new marginal tax brackets, but, as you will see, the lower brackets alone do not provide definitive guidance on the amount of your tax savings or even if you will save money at all. This is because the primary input to the new tax tables – your taxable income – is impacted by changes to how your taxable income is calculated in the first place. For instance, a taxpayer with $100,000 of taxable income in 2017 (subject to 2017 marginal tax brackets) who experiences no changes in the sources or amounts of income he or she receives in 2018 may have more or less taxable income that will be applied to the new lower marginal rates in the 2018 tables. In other words, $100,000 of taxable income in 2017 does not necessarily compute to $100,000 of taxable income in 2018. This dichotomy is largely attributable to the increase in the standard deduction, the elimination of personal exemptions, and numerous changes to the list of allowable itemized deductions.

I will walk you through these concepts in greater detail using tables to help quantify the impact of major changes. In the end, there is still enough complexity in the new rules that you will likely need to examine your personal income tax situation in detail to determine whether there is any meaningful benefit from the new rules, but you should at least have a better general understanding of where you stand.

THE NEW MARGINAL TAX RATES

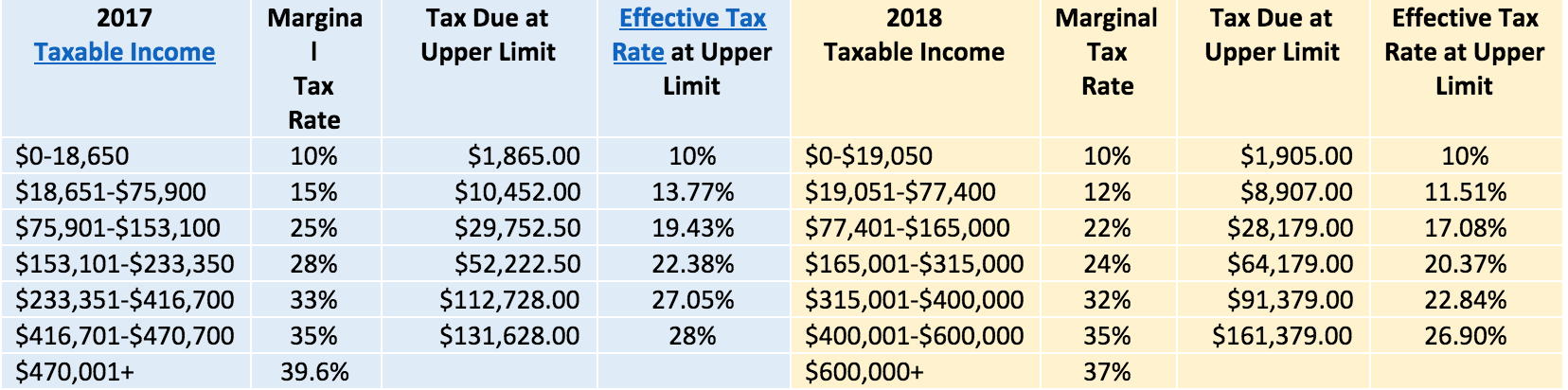

To show readers how the new tax brackets compare to the old, Tables 1A and 1B below offer a side-by side comparison of the 2017 and 2018 marginal tax rates and the effective tax rates for taxable income corresponding to each marginal bracket for married and single taxpayers, respectively.

TABLE 1A. 2017 vs. 2018 Federal Income Tax Bracket Comparison for Married Filing Jointly

(Source: Putnam Investments 2017 & 2018 Tax Rates, Schedules & Contribution Limits)

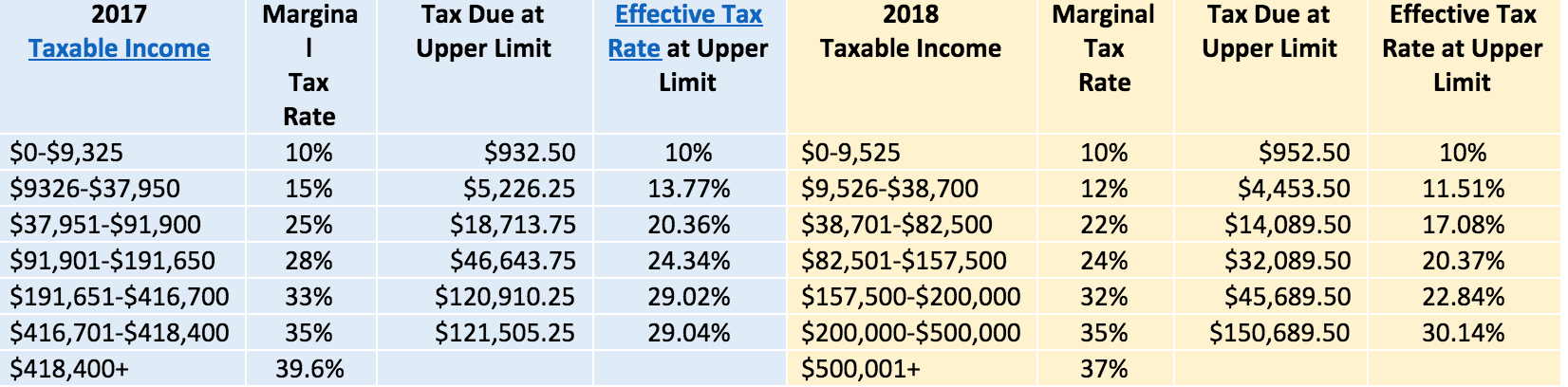

TABLE 1B. 2017 vs. 2018 Federal Income Tax Bracket Comparison for Single Taxpayers

(Source: Putnam Investments 2017 & 2018 Tax Rates, Schedules & Contribution Limits)

As illustrative as these tables may be, it is not immediately obvious which taxpayers may benefit the most from the new rates and by how much. To solve for this, Tables 2A and 2B on the following two pages compare the 2017 and 2018 income tax due for a broad range of taxable incomes for married and single taxpayers.

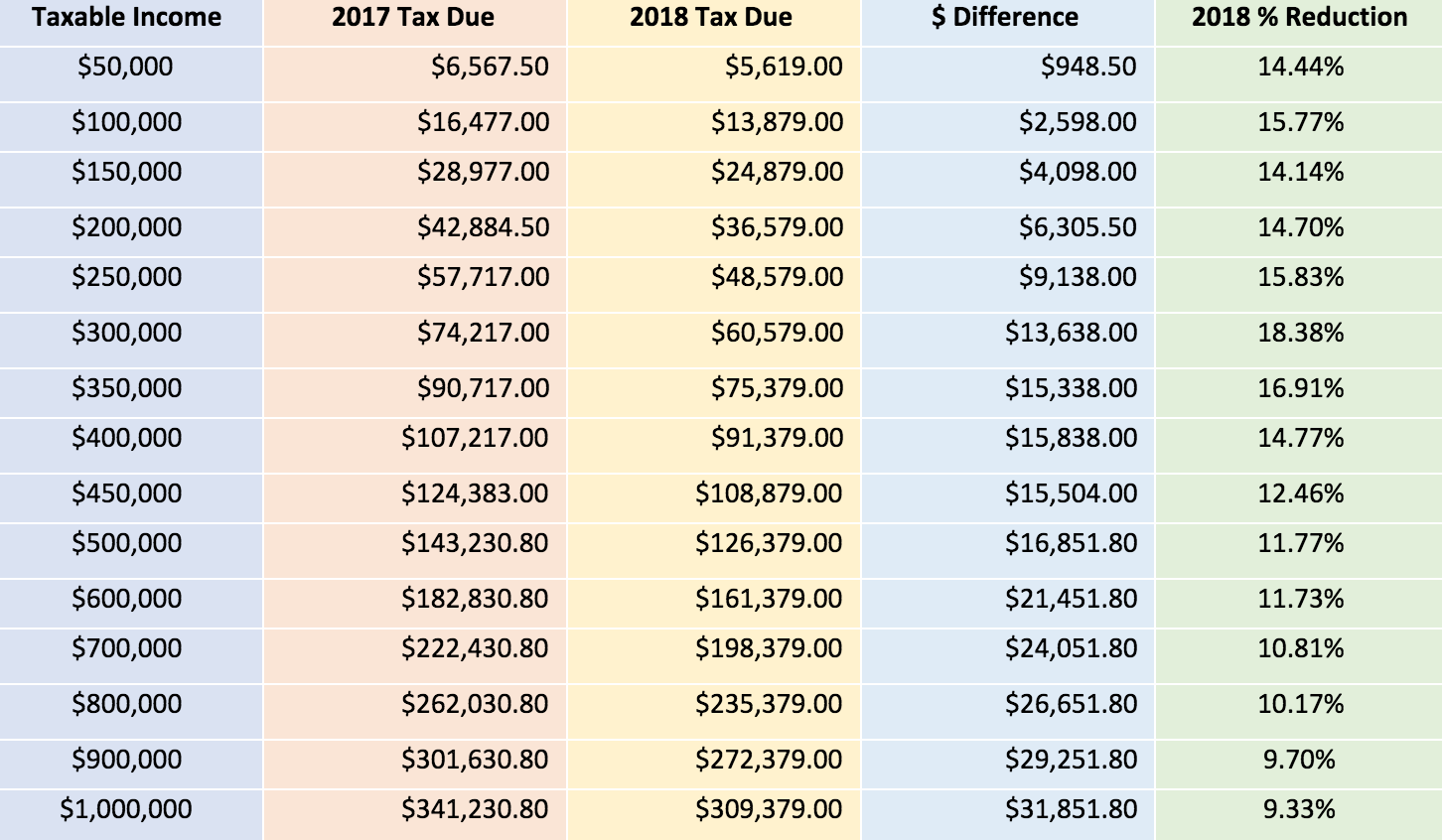

TABLE 2A. 2017 vs. 2018 Federal Income Tax Comparison for Married Filing Jointly at For Different Taxable Income Levels

(Source: TaxAct.com Tax Bracket Calculator)

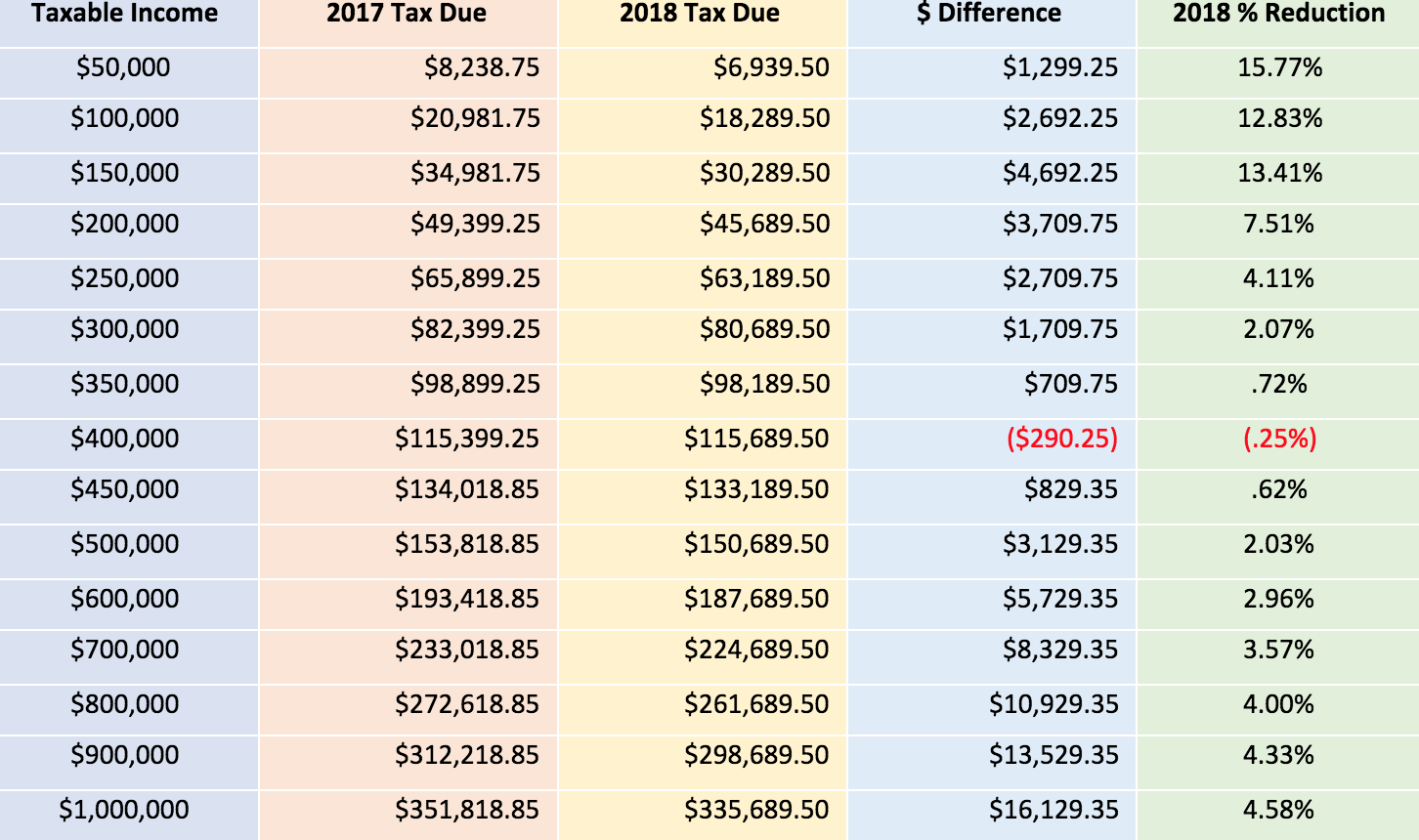

TABLE 2B. 2017 vs. 2018 Federal Income Tax Comparison for Single Taxpayers for Different Taxable Income Levels

(Source: TaxAct.com Tax Bracket Calculator)

As mentioned in the introduction, because of the differences in the way taxable income is calculated under the new law, readers should understand that the 2017-2018 side by side comparisons are not necessarily apples to apples and that these tables on their own do not give a complete picture of how you may be affected under the new law.

Still, there a couple of interesting observations that can be gleaned from the data. For instance, both tables seem to suggest that individuals and families with lower taxable incomes may benefit more in percentage terms than upper income earners. Additionally, although the new tax tables seem to be designed to provide at least some tax savings across all income levels, the savings to single taxpayers with incomes in the $300k-$500k range appear to be negligible or perhaps even slightly negative.

Married taxpayers also seem to benefit considerably more than single taxpayers. This is by design as reform-minded lawmakers sought to reduce the unpopular “marriage penalty” that existed under the old rules. Under the TJJA, the tax brackets for married filers are double those of single filers, except for the those in the top (37%) marginal bracket. With this new structure it appears that a marriage penalty is only felt at the highest income levels. The reason I say “appears,” however, is that the reality is not so simple. In fact, complexities in the tax code involving the Child Tax Credit and Earned Income Tax Credit can still produce a significant marriage penalty for lower income families. As with virtually all aspects of the new law, the devil is in the details. For more on this topic, see the following article - Marriage Penalties and Bonuses under the Tax Cuts and Jobs Act (Tax Foundation).

PERSONAL EXEMPTIONS VS. THE STANDARD DEDUCTION

With the combined doubling of the standard deduction and the reduction in marginal tax brackets, it would be tempting to conclude that all taxpayers are automatically better off under the new federal income tax structure. The reality, however, is far murkier. There are two primary reasons for this added complexity – the elimination of personal exemptions and the reduction or elimination of a number of popular allowable deductions. With respect to the former, some politicians have euphemistically referenced the elimination of personal exemptions as a “rolling up” of the exemptions into higher standard deductions for single and married taxpayers.

The implication of such rhetoric is that taxpayers will benefit from (or at least not be harmed by) this “simplification” of the tax code. For example, a single taxpayer in 2017 could claim the standard deduction of $6,350 plus a personal exemption of $4,050 to shield $10,400 from federal income tax. Under the new 2018 rules, the $12,000 standard deduction represents an additional $1,600 of income sheltered from taxation. Similarly, a married couple may claim the $12,700 standard deduction + $8,100 (two exemptions) for a total of $20,800 in excludable income. This is $3,200 less than the 2018 $24,000 standard deduction.

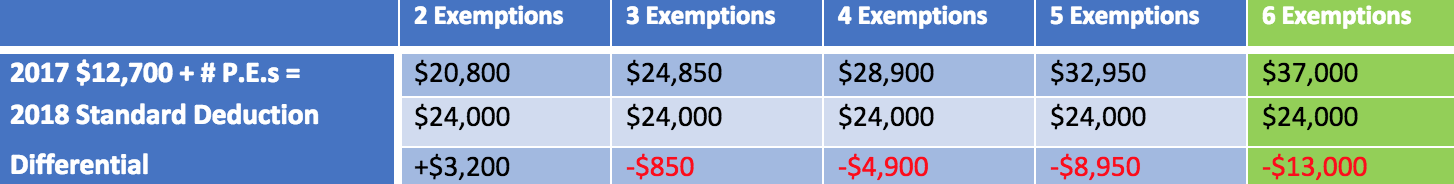

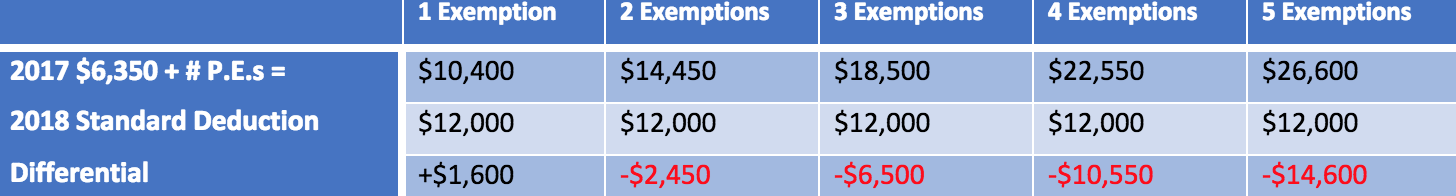

While this new math is simple enough to understand, the tax savings from the so-called “rollup” evaporates for taxpayers with qualifying dependents (e.g. children), each of whom provided a $4,050 tax exemption. This value differential is illustrated in Tables 3A &3B.

TABLE 3A. Married Taxpayers Filing Jointly – This table shows the amount by which a couple’s taxable income may be increased or decreased from 2018-2019 based upon the number of personal exemptions claimed in 2017.

TABLE 3B. Single Taxpayers – This table shows the amount by which one’s taxable income may be increased or decreased from 2018-2019 based upon the number of personal exemptions claimed in 2017.

As you can see, the elimination of personal exemptions beginning in the 2018 tax year significantly reduces the amount of income individual and married filers may shield from taxation as the number of dependents increases. To partially ameliorate the impact of the tax increase, Congress doubled the Child Tax Credit (CTC) from $1,000 to $2,000 and increased the eligibility phase-out levels to $200,000 for individual filers and $400,000 for married filers. Whether the tax credits are sufficient to offset the loss of the personal exemptions will depend upon your personal circumstances.

Using the Robinson family (married, four kids) as a hypothetical example (See green highlighted column in Table 3A). Given the same reported income as 2017, we stand to have $13,000 of additional taxable income in 2018 due to the difference between the $37,000 we could shelter in 2017 (standard deduction plus six P.E.s) and the 2018 $24,000 standard deduction sans exemptions. Assuming we are eligible for the CTC, we will have three qualifying dependents in 2018. So, at issue is whether the $6,000 child tax credit we will receive is sufficient to offset $13,000 of additional taxable income. In this example, it likely is pretty close to a wash.

It is worth noting, however, that the reason we will only be eligible for three qualifying child tax credits is that our oldest child is 18. The age cut-off for the CTC is 17, whereas the age limit for qualifying as a dependent child for personal exemptions was 24. If we had three kids in college and/or graduate school (a scenario we may face five years from now and which many families face today) we would have four (heavily) financially dependent children who, along with mom and dad, would have qualified as personal exemptions under the 2017 rules, but instead will be replaced by a single $2,000 child tax credit. Under this scenario, it is clear that CTC would not come close to offsetting the loss of six personal exemptions.

ITEMIZING VERSUS THE STANDARD DEDUCTION

The discussion thus far of the new marginal tax structure and the changes relating to the standard deduction, personal exemptions, and the CTC should begin to help quantify how you may fare under the new tax law. It it may also be dawning on you that most taxpayers who regularly elect to take the standard deduction will probably keep more of their income under the new law. But what about the 30% of taxpayers who have traditionally elected to itemize their deductions instead?

Spoiler Alert: It is difficult to envision scenarios in which taxpayers who itemized in 2017 and have the exact same reportable income this year, will fare better under the TCJA. Part of the reason for this, is that the doubling of the standard deduction paired with the elimination of the personal exemptions means that much more of one’s itemized deductions must be applied toward exceeding the standard deductions. For example, a single filer in 2017 only needs allowable deductions in excess of $6350 to benefit from itemizing. In 2018, however, the same filer with the same deductions must now apply $12,000 of allow deductions toward exceeding the standard deduction in order to receive any additional benefit from itemizing. In other words, the increase in the standard deduction effectively adds $5,750 of taxable income to single taxpayers and $11,500 to married filers!

To make matters worse, this tax increase may be exacerbated for millions of filers by the reduction or elimination of a number of important deductions. The most significant among these is $10,000 cap imposed on the deduction for State and Local Taxes (SALT) that include state income tax and real property tax. For taxpayers residing in states with high state income tax rates and/or in local areas with high property tax rates, the loss of thousands of dollars of previously allowed deductions may translate to thousands of dollars of additional taxes owed in 2018. Additional common deductions have been eliminated or curtailed under the TCJA include the deduction for home equity loan interest for purposes other than home improvement, the miscellaneous deduction for investment advisory fees and expenses, and the deduction for tax return prep expenses.

To illustrate this concept through example, Table 4 illustrates a hypothetical married couple filing jointly with two kids in college, $15,000 in state income tax, an $8,000 property tax bill, and $200,000 owed on a home equity loan at 4% interest they are using to help pay for college. It also includes common deductions for charitable contributions, investment advisory expenses, and tax return preparation fees.

TABLE 4

As you can see from the yellow highlighted bottom line of the table, the combination of the elimination of personal exemptions and the loss or restriction of several common deductions results in an additional $33,000 of taxable income for this hypothetical family for the 2018 tax year. The scenario depicted above is not uncommon, particularly high tax states, such as California, Hawaii, Massachusetts, New York, and New Jersey. The additional tax owed on this money is likely to far exceed any savings they might have hoped to realize from the lowering of the marginal tax rates. For more on this, see the following articles -

Tax reform: 9 tax deductions are going away in 2018 (USA Today)

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform (Forbes)

CONCLUSION

The purpose of this analysis was to give Financial Planning Hawaii clients a better understanding of whether the Tax Cut and Jobs Act will allow you to keep more of your hard-earned money in 2018. The following are some of the conclusions that may be drawn from this discussion:

Politicians who point to the new tax tables and the increase in the standard deduction to suggest ALL taxpayers will benefit from the TCJA are not being entirely truthful. The elimination of personal exemptions and the reduction and elimination of several popular itemized deductions means that the amount of one’s income subject to tax may be higher – perhaps even significantly higher – for many Americans in 2018 than 2017.

In general, married and individual taxpayers who routinely take the standard deduction are likely to keep more of what they earned under the new tax law, assuming the same amount and sources of income as 2017. Conversely, taxpayers who typically itemize are more likely to owe more tax as a result of the law.

There is little evidence to suggest that the TCJA favors “the rich.” Given that many of the benefits under the new law are phased out at higher income levels and that affluent investors are considerably more likely to itemize, it appears that higher income tax-filers will be among the largest segment of the population that pays more under the new rules.

One final obvious conclusion that may be drawn from this exercise is that the new tax law is complicated, and, for most taxpayers, it may take some rigorous legwork on Turbo Tax or with your CPA to determine exactly how much better or worse off you will be in 2018. It should be noted that the analysis provided in this report is simplified, and that readers should consult with their respective tax advisors before taking any action that may have tax consequences. I hope this exercise has been useful and informative.

See Also:

Winners and Losers in the New Tax Law (Kiplinger’s)

The GOP Tax Plan: Will You Win or Lose? (The Balance)

Top 20% of Americans will pay 87% of Income Tax (Wall Street Journal)

Post Script: How to Increase Your Deductions in 2018

While the preceding feature presented factors that may cause some people to pay more tax under the Tax Cuts and Jobs Act, all taxpayers should be aware of opportunities to reduce their tax burden through "above-the-line" deductions (a-t-l-ds). The low hanging fruit are pre-tax contributions to HSAs, IRAs, and qualified retirement plan accounts, but there are other a-t-l-ds as well. For further insight, see the following articles:

Above the Line Deductions You Can Take Without Itemizing (Nolo.com)

Top 20% of Americans Will Pay 87% of Income Tax (Wall St. Journal)