Get To Know Us Better

Many financial advisors use financial planning as a euphemism for investment planning. Comprehensive financial planning is so much more than just portfolio management. It encompasses estate planning, tax planning, asset registration and beneficiary designations, employee benefits, insurance risk management, debt management, social security benefits planning and much more.

At Financial Planning Hawaii, we approach financial planning as a treasure hunt. We gather our clients’ detailed financial information and documents into a secure online platform and then sift through it to find mistakes, oversights, and potential opportunities. With more than 30 years of experience, we know where to look and we are well-versed in the myriad rules which may be applied (or avoided) to help improve our clients’ financial lives. It is not uncommon for us to point out as many as 20 or 30 findings (financial planning "treasure") in a single planning review. It is this treasure hunt that fuels our passion, and our clients appreciate the value we provide beyond just wealth management.

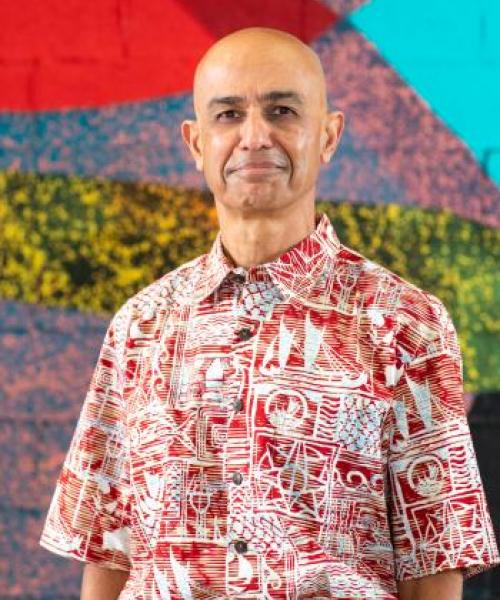

The FPH Team

ARE YOU ON TRACK TO MEET THESE COMMON PLANNING OBJECTIVES?

The applications below help address investors’ greatest fear – If things go badly in the markets will I still be okay?

Nest Egg Guru makes client facing software to help financial advisors engage with and educate clients and prospective clients. The company was co-founded by J.R. Robinson and is the sister company to Financial Planning Hawaii.