Timely Tidbits - News & Alerts For Financial Planning Hawaii Clients (June 2025)

By J.R. Robinson, Financial Planner (May 2025)

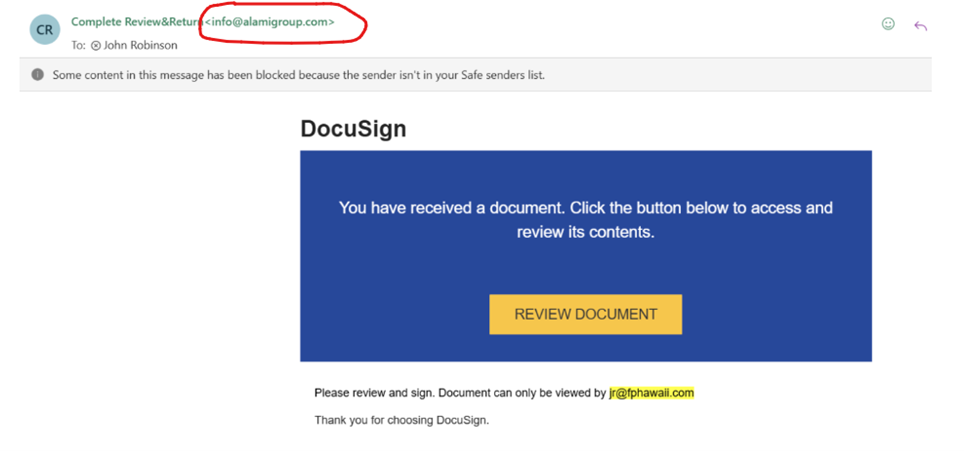

Can You Spot the Spoof?... Below is an email I received last month. We send and receive DocuSign documents all the time, so it would be easy to fall for this phishing ruse. However, a quick check of the sender’s email address (circled in red) made it easy to discern that this is a phishing scam and that I should not click on the Review Document button.

One More Reason Why You May Wish to Amend Your 2024 State Tax Return?… In previous communications, I raised client awareness that Schwab did not provide any direct notice to clients who held Schwab Treasury Money Fund that the dividends paid by the fund in 2024 were 99.99% attributable to state tax-exempt interest from T-bills. Instead, Schwab reports them as ordinary taxable dividends on form1099-DIV.

I have since learned that Schwab also provides no information on its 1099-INTs or in any other format to alert clients and their tax preparers that interest earned on bonds issued by Federal Home Loan Bank and Federal Farm Credit Bank are also exempt from state income tax. We have many clients who live in high-tax states such as HI, CA, NY, NJ, OR, and MA who own these bonds in taxable accounts and would benefit from that state tax exclusion.

If you live in one of these states, check your Schwab 1099-INTs to scan for interest from these bonds, and to also check their 1099-DIVs for the amount of income they received from Schwab Treasury Money Fund (SNSXX or SUTXX). If the amount is substantial, it may be worth your while to amend and re-file your state tax return.

Schwab Class Action – Corrente, et.al. v. Schwab… We have received numerous inquiries from clients who received the settlement notification letters regarding this class action lawsuit. The plaintiffs in the suit allege that TD Ameritrade account holders were harmed by Schwab’s acquisition of TD. Details of the settlement may be found here: www.SchwabCorrenteSettlement.com.

All Schwab account holders who have received this letter, including most FPH clients, are automatically included in the class action, and will need to proactively opt out if they wish to retain their right to participate in further litigation on this issue against Schwab. While I am unable to provide specific legal advice on this matter, by my read, the suit does not appear to include any financial compensation to the class members but does pay a considerable sum to the law firms who are bringing the suit.

Equitable is Offering the Opportunity to “Novate”... We have received a number of communications from clients with long-held Equitable annuity contracts that were issued in the early 2000s and have received an offer to “novate” their contracts. As best as we can tell, insurance and annuity distributor, Venerable Holdings (formerly “Voya”) has acquired a block of Equitable's old annuity contracts. As such, Equitable has sent letters to contract holders inviting them to agree to exchange their existing annuity contracts for identical ones from Venerable.

At issue, however, is the fact that Equitable has been abstruse in its disclosures and has deflected all attempts from my office to discern what, if any, benefit is being conferred to contract holders from the change. The latest contract holder communication indicates that anyone who does not proactively reject the offer will automatically be deemed to have agreed to novate.

As always, I am not permitted to provide specific legal advice on this matter. However, if you do not wish to novate (i.e., exchange your original equity contract for Venerable’s new one), you must return the letter they sent with a specific indication that you reject the offer.

John H. Robinson is the owner/founder of Financial Planning Hawaii and Fee-Only Planning Hawaii. He is also a co-founder of fintech software maker Nest Egg Guru and the new personal finance website NestEggPF.com.