The Most Impactful Tax Law Changes in 2025

By John H. Robinson, Financial Planner/Founder (December 2025)

The most significant piece of tax legislation in 2025 was the One Big Beautiful Bill Act (OBBBA). It was signed into law on July 4, 2025, and, while its primary purpose was to make permanent several expiring components of the 2018 Tax Cuts and Jobs Act (TCJA), it also ushered in a slew of new rules. This article provides a summary of the bill and highlights provisions that are most salient to Financial Planning Hawaii clients.

Key Provisions of the TCJA that were Made Permanent by the OBBBA for Individual Taxpayers

Individual Income Tax Rates

The current seven tax brackets and their corresponding rates (10%, 12%, 22%, 24%, 32%, 35%, and 37%) were made permanent, preventing them from reverting to higher pre-TCJA levels.

Standard Deduction

The significantly increased standard deduction amounts from the TCJA were made permanent and will continue to be adjusted for inflation.

Personal Exemptions

The suspension of personal exemptions, a TCJA change, was made permanent.

Estate and Gift Tax Exemption

The increased federal estate and gift tax exemption (which grew to nearly $14 million per person in 2025) was made permanent at an even higher starting point of $15 million per person in 2026, indexed for inflation thereafter.

Miscellaneous Itemized Deductions

The repeal of most miscellaneous itemized deductions subject to the 2% floor (e.g., unreimbursed employee expenses, tax prep fees) was made permanent. NOTE: For FPH clients, this unfortunate provision means that investment advisory fees and CPA tax preparation fees for individual taxpayers (but not business owners) will remain non-deductible. To the extent that the IRS permits, we will continue to implore clients to pay as much of their advisory fees as is allowable from pre-tax retirement accounts.

Mortgage Interest Deduction Limit

The limit on deducting home mortgage interest for debt up to $750,000 (or $1 million for older mortgages) was made permanent.

Alternative Minimum Tax (AMT)

The higher AMT exemption amounts and phase-out thresholds implemented by the TCJA were made permanent, though the phase-out thresholds will begin sooner for high-income earners starting in 2026.

Key Provisions of the TCJA that were Made Permanent by the OBBBA for Businesses

Qualified Business Income (QBI) Deduction

The 20% pass-through deduction for qualified business income (Section 199A) for eligible owners of pass-through entities was made permanent. NOTE: This will likely continue to make Sub-Chapter S corporations an attractive structure for small business owners.

Bonus Depreciation

The provision allowing for 100% bonus depreciation for qualified new and used business assets was reinstated and made permanent for property acquired and placed in service after January 19, 2025.

R&D Expensing

The ability to immediately deduct domestic research and development (R&D) expenses in the year they are incurred was made permanent, starting with the 2025 tax year.

New Tax Rules Introduced by the OBBBA

Two New Charitable Deduction Options for Non-Itemizers

Under OBBBA, taxpayers who take the standard deduction can deduct up to an additional $1,000 (for single filers) or $2,000 (for joint filers) of cash charitable contributions as above-the-line deductions starting in 2026. For taxpayers who rarely or never itemize, the new rule offers a new opportunity to deduct charitable contributions.

Additionally, for taxpayers on the brink of itemizing, but who don’t necessarily itemize every year, can now opt ito temize and have charitable contributions subject to a .5% of AGI floor or take the standard deduction and use the non-itemizer deduction.

Two New Benefits Added to 529 College Savings Plan Rules

The OBBBA increased the distribution amount from 529 plans that may be used to pay qualifying K-12 related expenses from $10,000 to $20,000. Qualifying expenses include tuition, curriculum materials, standardized testing ees, post-secondary enrollment fees, outside tutoring. Additionally, the new law expanded the definition of qualifying expenses to include professional certification fees (e.g., FINRA exams, CFP Prep, CFA prep, etc.), apprenticeship programs, and other occupational licenses.

State and Local Tax (SALT) Limit Increased

The OBBBA increased the SALT limit from a paltry $10,000 per year to $40,000 per year. This is arguably the most impactful of the new rule changes because it will compel millions taxpayers' itemized deductions to exceed the standard deduction again. The SALT limit is slated to increase by 1% each year through 2029 and then revert back to $10,000 in 2030.

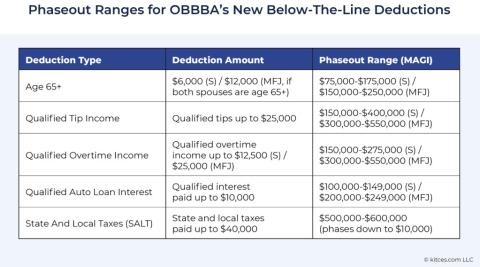

New Temporary Deductions

Seniors (age 65+), workers who receive tip compensation, workers who receive overtime pay, and taxpayers who pay interest on auto loans. All of these temporary deductions are effective for the 2025 through 2028 tax years. All except the aforeferenced SALT deduction are set to expire in 2029. The table below from Kitces.com summarizes the temporary deductions.

It is worth mentioning that all of these temporary deductions create an incentive for taxpayers to keep their incomes under the phaseout thresholds. This may have an impact on taxpayer decisions regarding the timing and amount Roth conversions. It may also cause taxpayers to change the source of income from pre-tax retirement accounts to Roth accounts. It may even impact consumers' Social Security claiming decisions.

The Trump Account

Per the IRS website, this novel account type represents a new form of IRA established for elgible children under the OBBBA. The accounts serve as a pilot program aimed at combatting multigenerational poverty. Under the program, the federal government will make a one-time $1,000 pilot program contribution to the Trump Account of each eligible child for whom an election is made, who is a U.S. citizen and who is born on or after Jan. 1, 2025, through Dec. 31, 2028. Additonal contribuitons of up to $5,000 per year may be made thereafter, but are not required. The accounts may be established by a parent or guardian. The funds in Trump Accounts must be invested in certain mutual funds or exchange-traded funds that track the S&P 500 or another index of primarily American equities. Amounts generally cannot be withdrawn from Trump Accounts before January 1st of the calendar year in which the child turns 18 years old. After that point, the account generally is treated as a traditional IRA and generally is subject to the same rules as other traditional IRAs. See IRS Notice 2025-68 - Notice of intent to issue regulations with respect to section 530A Trump accounts

SECURE Act 2.0 New Rules for 2025 & 2026

The SECURE Act 2.0 was signed into law in December 2022 with many of its provisions going into effect in 2023 and 2024. Although largely overshadowed by the OBBBA, the 2.0 Act did introduce a few new provisions in 2025 that may be relevant to FPH clients. These new rules include the following:

- Student Loan Matching Contributions – Effective beginning in 2025, employers will be permitted to match employees’ student loan payments with contributions to their retirement accounts. Congress’ purpose in creating this provision is to hep workers who otherwise might miss out on employer matching contributions by focusing on paying down their student loan debt.

- “Super” Catch-Up Contributions to Qualified Plans for Partcipants Age 60-63 – This new rule allows plan participants in this age range to contribute and additional $11,250 into their 401(k) accounts instead of the standard $8,000 catch-up contribution for all other participants age 50 and older. These amounts are unchanged for 2026.

- Income-Based Roth Catch-Up Requirement – Beginning in 2026, qualified plan participants age 50+ plan who earn more than $150,000 in FICA wages will only be permitted to make catch-up contributions to after-tax Roth accounts. If the employer plan does not allow Roth accounts, then no catch-up contributions will be permitted for these participants.

The SECURE Act 2.0 contains a host of other qualified plan rules that went into effect to effect in 2025 as well. These include the creation of “pension-linked emergency savings accounts" (PLESAs), expanded plan eligibility to long-term, part-time employes (LTPTEs) who work more than 500 hours per year but less than 1,000 hours, and expanded auto-enrollment rules. We have many small business owner clients. My impression so far is that this particular set of new rules has brought unwanted complexity and costs to existing plans, and may actually lead many employers to terminate their 401(k) plans.

RELATED READING

2025 End-of-Year Tax Planning Under OBBBA: Roth Conversions, Charitable Contributions, QBI Planning, And More (Kitces.com)

Catch-Up Contributions 2025 and 2026 (Charles Schwab)

SECURE Act 2.0: Key Provisions Taking Effect in 2025 (Corrigan Krause CPAs)

John H. Robinson is the founder of Financial Planning Hawaii and Fee-Only Planning Hawaii and a co-founder of retirement simulation software-maker, Nest Egg Guru.

Although representatives of Financial Planning Hawaii may review client tax and legal documents, deliver tax-reporting documents, and raise awareness of potential tax and/or estate planning related mistakes or opportunities, none of this information should be construed as constituting specific tax or legal advice. All clients are encouraged to consult with their respective CPAs and/or attorneys for such guidance.