Do You Understand the Difference Between Your Marginal Tax Rate and Your Effective Tax Rate?

By John H. Robinson, Financial Planner (December 2025)

Read the full post from Cody Garrett, CFP

Differences Between Marginal & Effective Tax Rates

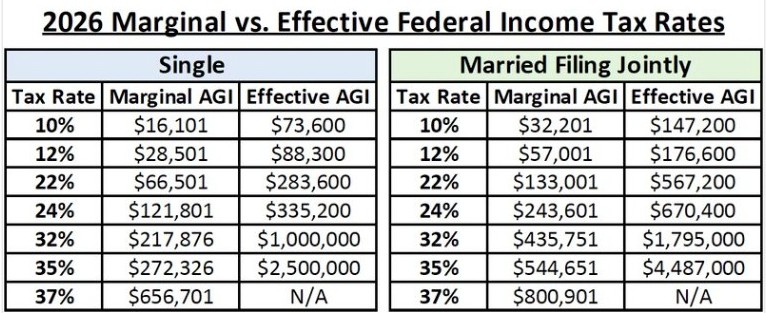

Last week, financial planner Cody Garrett of Measure Twice Financial Planning posted the table above to illustrate the difference between marginal and effective tax rates. A purpose of his post was to explain that the U.S. imposes a graduated, tiered tax structure in which the higher tax rates are only applied starting from the first dollar above the preceding lower rate threshold. Additionally, the author sought to point out how the standard deduction paired with the tiered rate structure impacts the actual “effective” rate that U.S. taxpayers owe on the income they report each year on the 1040s.

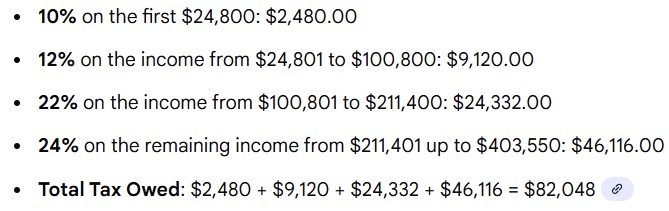

To illustrate this by example, a married couple filing a joint tax return with 2026 $435,750 Adjusted Gross Income (AGI) (the exact top of the 24% federal marginal tax bracket) will owe total federal income tax of $82,048. This rate represents an effective tax rate of 20.33% on taxable income and 18.83% on AGI. Here is a breakdown of the calculations [Source: TaxAct Tax Bracket Calculator]:

Step 1: $435,770 AGI less $32,200 2026 MFJ Standard Deduction = $403,550 taxable income.

Step 2: Calculate the federal income tax owed for each marginal bracket –

Step 3: $82,048 divided by $403,550 = 20.33% = Effective tax rate on taxable income

Step 4: $82,048 divided by $435,550 = 18.83% = Effective tax rate on AGI

Dispelling Common Consumer Misconceptions

This calculation dispels the common consumer misconception that just barely crossing into the next higher tax bracket causes that tax rate to apply to the total taxable income back to dollar-one. That is definitely not how our tax system works. In this example, raising AGI to $435,751 in 2026 will result in a 32% tax levied on just the one additional dollar. It would have no impact on either of the above-referenced effective tax rates.

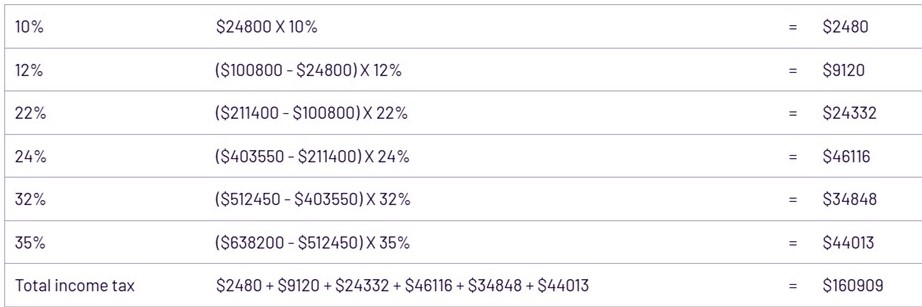

In fact, as Cody cleverly articulates, in order to actually pay a 24% tax rate on adjusted gross income in 2026, married taxpayers will need to have 2026 AGI of $670,400! At that income level, the MFJ couple would be in the 35% marginal bracket and would owe $160,909 in federal income tax. See calculations below:

Step 1: $670,000 AGI less $32,200 2026 MFJ Standard Deduction = $638,200.

Step 2: Calculate the federal income tax owed for each marginal bracket –

Step 3: $160,909 divided by $638,200 divided by $160,909 = 25.21% = Effective tax rate on taxable income.

Step 4: $160,909 divided by $670,400 = 24.0% Effective Tax Rate on AGI

NOTE: Cody’s tax math is intentionally simplified to discount the potential additional impact of the Medicare surcharge (IRMAA) and /or the Net Investment Income Tax (NIIT). By assuming the standard deduction the analysis also ignores the potential impact of the Alternative Minimum Tax (AMT) on the tax rate paid by certain high income taxpayers.

Real World Tax Planning Implications - Roth Conversions

Although not expressly stated, Cody’s post could be interpreted by readers as suggesting that consumers who follow the common guidance of filling up the 24% marginal tax bracket with partial Roth conversions may be making a sub-optimal decision, since they could take out far more and still have an effective rate of 24% or less. As I noted in a comment to the post, I respectfully disagree with that supposition. The 24% effective tax rate on gross income in the illustration above is an artificial construct that requires taxpayers to pay 32% tax on distributions that raise taxable income from $403,551 to $512,450 and 35% tax income from $512,451 to $638,200.

The generally accepted wisdom in the financial planning community is that it is prudent to process conversions and distributions at lower tax rates today if you believe it will avoid distributions at higher rates in the future. If the taxpayer can spread distributions over a longer period of time to avoid paying 32% tax on any distributions, then the popular practice of filling up the 24% marginal bracket may still be a better tax minimization/optimization strategy. This is not to say that there are no situations in which processing partial Roth Conversions above the 24% marginal bracket may be advisable.

There are definitely scenarios where high marginal rate conversions may be shrewd planning. For example, taxpayers with large taxable IRA or Qualified plan balances may wish to take large conversions that raise their effective tax rates to 24% or even slightly more or more if they believe there is a chance that RMDs may spell higher tax rates for them in retirement. It may also make sense to process large conversions between age 59 1/2 and age 70 to plan around Medicare premium surcharge (IRMAA) and adding Social Security retirement to one's taxable income. Having large Roth balances can be extremely helpful in managing marginal tax rates in retirement and they are much better from an estate planning perspective than inheriting large pre-tax IRA balances as well. However, as you can see from the multiple factors that go into the planning equation, the complexity of high marginal rate conversions makes it advisable to include your CPA or other tax adviser in the discussion.

John H. Robinson is the founder of Financial Planning Hawaii and Fee-Only Planning Hawaii and a co-founder of retirement simulation software-maker, Nest Egg Guru.

Although representatives of Financial Planning Hawaii may review client tax and legal documents, deliver tax-reporting documents, and raise awareness of potential tax and/or estate planning related mistakes or opportunities, none of this information should be construed as constituting specific tax or legal advice. All clients are encouraged to consult with their respective CPAs and/or attorneys for such guidance.