The Most Underrated Factor in Retirement Income Sustainability By John H. Robinson

As a practical matter, the factors that determine how long our accumulated nest eggs may last after we retire fall into two categories – those that we can control and those we cannot. Primary factors that are largely beyond our control include, of course, capital markets returns (sequence of returns risk) and how long we may live (longevity risk). Factors that are, at least to some degree, within our control include:

- Annual withdrawal amount

- Annual withdrawal adjustment (cost of living increase)

- Asset allocation

- Investment expenses

- Withdrawal strategy

While each of these has been explored in academic research, a review of popular financial planning applications finds that the influence of the choice of withdrawal strategy has been largely ignored at the consumer/practitioner level. In fact, nearly all programs assume that retiree portfolios maintain a constant allocation with annual portfolio rebalancing throughout retirement. Under these models, withdrawals from the various asset classes are typically made in proportion to their weight in the portfolio followed by portfolio rebalancing. The unanimity with which this methodology has been applied has effectively led to the implicit assumption that constant allocation with annual rebalancing is an efficient withdrawal strategy for real world portfolios. But is this truly the case?

To illustrate the influence that the choice of different withdrawal strategies may have on retirement income sustainability, we consider the following reasonably realistic retirement planning scenario:

- 30-year retirement horizon

- $1 million initial retirement portfolio value

- 5% ($50,000) initial withdrawal rate

- 3% annual cost of living increase

- 60:40 stocks:bonds allocation with equities allocated 50% large cap, 30% small/mid-cap, and 20% International. Bonds are assumed to generate a constant 2% fixed rate of return throughout retirement (this is roughly equivalent to the current 10-year treasury yield)

- 1% annual investment expenses

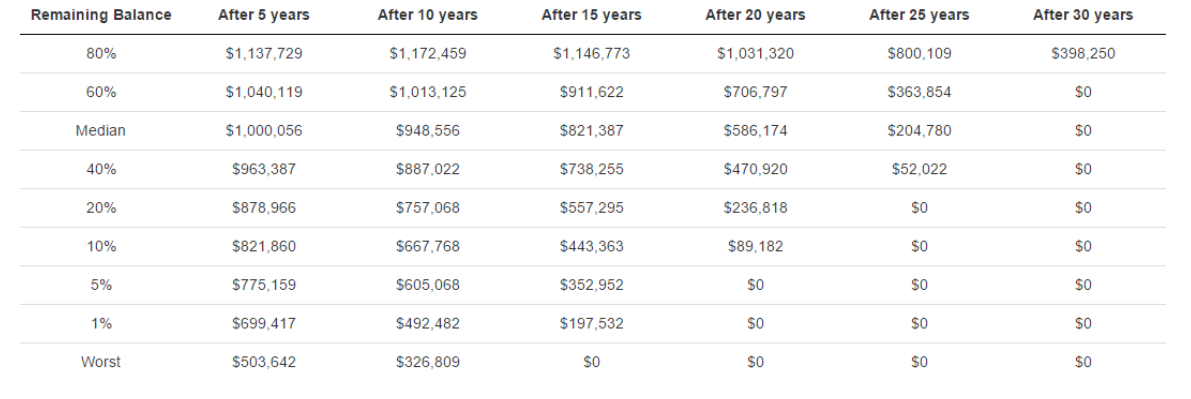

Using these portfolio conditions, four different withdrawal strategies were tested using Nest Egg Guru’s Retirement Spending Calculator. The results of 5,000 bootstrapping simulations for each of the four strategies tested are presented in the tables below. The output presents remaining portfolio balances in 5-year increments across the range of simulations for each strategy, as well as the percentage of the 5,000 simulations that were successful (i.e., the simulations that did not run out of money in the 30-year time horizon).

Table 1: Constant allocation with annual rebalancing

Successful portfolios out of 5,000 simulations = 33%

Table 2: Spend stocks first, then bonds (decreasing equity glidepath)

Successful portfolios out of 5,000 simulations = 28%

Table 3: Spend bonds first, then stocks (increasing equity glidepath)

Successful portfolios out of 5,000 simulations = 84%

Table 4: Guardrail Strategy (constant allocation, don’t spend stocks after down years)*

Successful portfolios out of 5,000 simulations = 60%

*The guardrail strategy illustrated in involves shifting the gains, if any, from the stock and bond portions of the portfolio at the end of each year to cash and then spending down the cash, first followed by bonds and then stocks. Under this approach equity allocations are, thus, not reduced following negative return years, until all of the cash and bond allocations have been exhausted.

The results presented in these four tables clearly illustrate that the choice of withdrawal strategy may have a dramatic effect on retirement income sustainability. The results also show that the widely adopted constant allocation withdrawal strategy may be sub-optimal and may lead to overly pessimistic simulation results. While the difference between the constant allocation and “bonds-first” withdrawal strategy is surprisingly dramatic, it is generally consistent with previously published research. For example, in a June 2007 Journal of Financial Planning paper by SUNY professors John Spitzer and Sandeep Singh entitled, Is Rebalancing a Portfolio during Retirement Necessary, the authors demonstrated the superiority of a similar bonds-first withdrawal strategy and concluded,

“While the wisdom of rebalancing in the accumulation phase of the life cycle is widely accepted, the wisdom does not appear to extend to the withdrawal phase…Rebalancing during the withdrawal phase provides no significant protection on portfolio longevity.”

More recently, in a 2104 Journal of Financial Planning piece entitled, Reducing Retirement Risk with a Rising Equity Glide Path, noted retirement researchers American University Wade Pfau and Nerd’s Eye view blogger Michael Kitces reached a similar conclusion about the value of avoiding equity withdrawals early in retirement as a tool for ameliorating sequence of returns risk.

In summary, while this article is intended to draw attention to the fact that withdrawal strategy is an overlooked and critically important consideration in determining income and portfolio sustainability, it is not necessarily intended to suggest that the bonds-first approach illustrated herein is the optimal solution. Indeed, a number of papers have been published recently proposing a range of dynamic withdrawal strategies that are likely superior the ones presented in this paper. Whether these strategies are practically implementable by consumers and their financial planners is a matter for further discussion.

Additionally, all readers should understand that the output from retirement planning calculators can vary widely from one application to the next, depending upon the calculators’ inputs and methodologies. Critical thinking is required by the user in evaluating the merits and limitations of all retirement planning calculators. For its part, Nest Egg Guru was designed to give consumers and financial planners an intuitive, reasonably realistic means of modeling and assessing retirement preparedness and of testing how changing the factors that are within their control may impact their results. Readers are welcome to test Nest Egg Guru for themselves at www.NestEggGuru.com.

Disclosure

The information contained in this report is intended for informational purposes only. This information is not intended as a solicitation or an offer to buy, sell or hold any security. Investments and strategies mentioned may not be suitable for all investors. Examples and illustrations included herein are hypothetical only, actual results will vary. Past performance is no guarantee of future results. As with all investments, various risks may exist, and we recommend you consult with your financial advisor prior to making any investment decisions. Neither the author nor JW Cole/JW Cole Advisors provide legal or tax advice.

John H. Robinson is the co-founder of Nest Egg Guru and the owner of Financial Planning Hawaii. Research papers he has written or co-authored have appeared in numerous peer-reviewed academic journals. Papers he co-authored on retirement income sustainability won the 2008 CFP Board of Standards and the 2010 Institute for Retirement Education (InFRE) best paper awards, respectively.