SUPER DUPER IMPORTANT TAX REPORTING INFORMATION FOR FPH CLIENTS WHO OWN CHARLES SCHWAB U.S. TREASURY MONEY FUND (SNSXX or SUTXX) IN TAXABLE ACCOUNTS

By John H. Robinson, Financial Planner (January 31, 2026)

I spent hours racking my brain to come up with a title that conveys both the importance and relevance of this article. I think I nailed it.

In all seriousness, it was disheartening to learn last tax season that some of our flock did not inform their tax preparers that the dividends paid on their treasury money market fund shares and reported on their 1099-DIVs are 99.99% exempt from state income tax. This is a non-issue for people living in a state with no income tax, such as New Hampshire, Florida, Washington or Texas, but it can be a costly oversight if you live in a high-income tax state, such as New York, Oregon, California, and our beloved Hawaii.

Here’s the Rub…

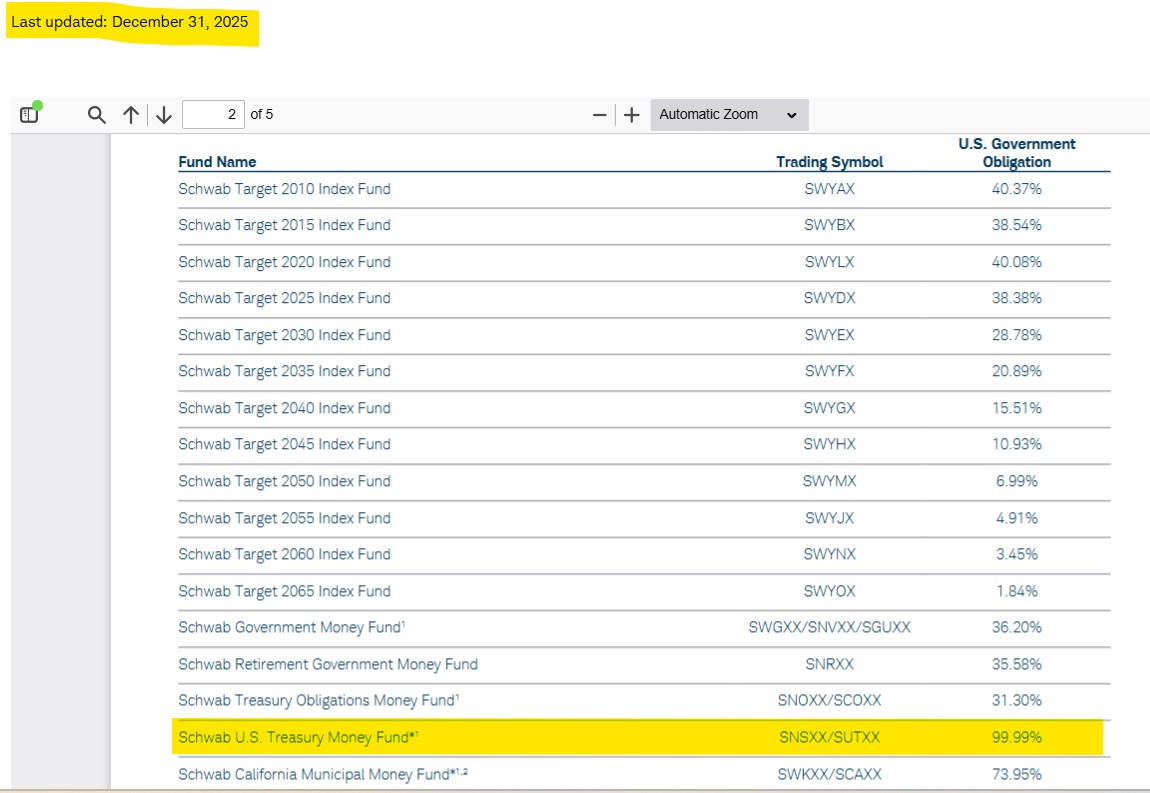

The Source of the problem is that Charles Schwab reports all money market fund dividends as taxable because some or all of most money market mutual fund dividends are derived from short-term fixed income instruments that are fully taxable (i.e., both state and federal). However, because the Schwab U.S. Treasury Money Fund invests almost exclusively in ultra-short term U.S. treasury obligations that pay interest that is exempt from income tax in all states, nearly all (99.99%) of the interest reported on the 1099-Div for this fund is exempt tax. Your CPA or tax preparer will not know this unless you tell them!

SEE: How Are Treasury Bills Taxed (Investopedia)

What You Need For Proof

Each Year Charles Schwab issues a Supplementary Tax Guide Showing the various funds in its proprietary fund stack that derive at least some portion of their dividend income from treasuries. The 2025 guide was just released. Here is a link –

https://www.schwabassetmanagement.com/resource/2025-supplementary-tax-information

Alternatively, you can share this article with your tax preparer too.

Since part of my job is to look for every possible way to help our clients avoid costly mistakes, it kills me when people overlook this. That is why I am raising awareness early this year. If you or your tax preparer has questions, do not hesitate to reach out.

One More Thing…

Interest Paid on Federal Home Loan Bank (FHLB) and Federal Farm Credit Bank (FFCB) bonds are exempt from state income tax too! However, the interest is reported as taxable on your 1099-INT. Your CPA or tax preparer is not likely to catch this, especially during the frenzy of tax season. Read over your Schwab 1099-INT carefully to look for these.

See: U.S. Government Agency Bonds (Vangaurd)

John H. Robinson is the founder of Financial Planning Hawaii and Fee-Only Planning Hawaii and a co-founder of retirement simulation software-maker, Nest Egg Guru.

Although representatives of Financial Planning Hawaii may review client tax and legal documents, deliver tax-reporting documents, and raise awareness of potential tax and/or estate planning related mistakes or opportunities, none of this information should be construed as constituting specific tax or legal advice. All clients are encouraged to consult with their respective CPAs and/or attorneys for such guidance.