JR'S Two Cents - February 2026

Looking for your Schwab Tax Documents?

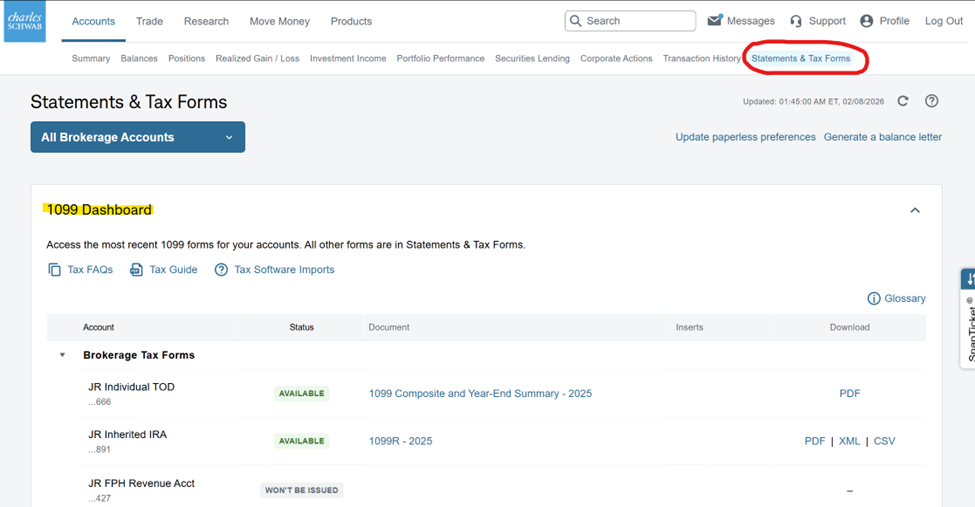

You don’t need to wait for the mail - just log into the Schwab Alliance website and check your documents’ status on the Schwab 1099 Dashboard.

For clients who took taxable distributions from retirement accounts, including inherited IRAs, in 2025, the 1099-Rs have been issued and are posted on the Schwab Alliance website. Composite 1099s (1099-INT, 1099-Div & 1099-B) are being rolled out through out February.

NOTE: Clients who transferred from NFS to Schwab in advance of our migration to Charles Schwab, may receive 1099s from both custodians.

Is it Time to Dump eMoney?

As every FPH and FOPH client knows, eMoney is the foundation of our financial planning process. The platform enables people to neatly centralize, organize, monitor and maintain all aspects of their financial lives. I have been using eMoney for 15 years. FPH pays nearly $10,000 per year ($2,345 per quarter) to give an unlimited number of clients access to eMoney. It is the most widely used software in the financial planning space.

Unfortunately, the quality of the service from eMoney has significantly declined. The most persistent complaints from our clients pertain to frequently dropped connections to linked bank and investment accounts. In my opinion, it would be a much better user experience if Fidelity (eMoney’s owner), adopted Plaid as its account aggregation engine. Plaid is the most widely used and highly rated aggregator and is used in popular personal finance applications such as SoFi and Venmo.

How Financial Aggregators Fuel Fintech Solutions

Fidelity said it has no plans to incorporate Plaid and remains committed to developing its own APIs for linking institutions. That commitment has not been going well.

Most recently, a software glitch from an eMoney “upgrade” has caused the account type of all linked accounts to be changed to “529 Plan.” eMoney says it is aware of the problem but “does not have the resources” to devote to a fix! The advice from eMoney Support is for me and my team to make corrections one-by-one for each client. That is a colossal and untenable undertaking.

So, is it time to dump eMoney? The short answer is, NO.

I have been researching competing platforms for years and have determined that there are two insurmountable barriers to switching. First, it would be enormously disruptive to our clients. Second, we have literally hundreds of thousands of client documents stored in the eMoney Vault and they are not mappable or transferrable to any new platform.

I suspect that eMoney knows we are captive. I truly HATE that eMoney is sometimes a source of irritation to our clients. That is the exact opposite reason why I pay so much each year for our subscription. It is what it is.

Since there is no viable alternative, we are committed to keeping eMoney as our financial planning platform. For our use-case, it is still the best software. The best solution for mitigating client frustration is to reach out to us as soon as you encounter problems instead of allowing frustration to mount. Sue Gabor remains our eMoney trouble-shooting guru. She is usually able to assess very quickly whether the issue is solvable or not.

Should We Be Moving Money Out from Stocks to Cash In Anticipation of a Stock Market “Crash”

This is a common client question. It is also a loaded question. For the bazillionth time, the stock market is not predictable and timing one’s entry into and out of the stock market is a proven losing long term strategy. 2025, serves as a case-in-point. Many pundits began the year with dire predictions, and yet the S&P 500 rose 16%.

At the same time, readers of my content, are familiar with my common refrain that “the best time to prepare for a prolonged downturn is before it happens.” This is not as paradoxical as it sounds. The beginning of each year is a great time to review your portfolio allocation. If you spent down cash and bonds last year, maybe it makes sense to replenish what you spent.

The worst time to sell stocks is when they are down. We have no idea whether the U.S. stock market will rise from here, but we do know for a fact that it is not depressed now. In fact, the S&P 500 index made a new all-time high last week.

This is particularly relevant to FPH clients who are retired and are spending from their portfolios. I always preach that retirees should strive to maintain 5-7 years worth of potential living expenses in risk-free assets to protect against sequence of returns risk. If you have not already done so, now may be a great time to replenish risk free assets that were spent last year. If you are particularly worried about the investment environment, you may wish to have seven years of income set aside instead of five.

Don’t Forget to Take Your RMDs!

At the end of last year, Vanguard published an article revealing that approximately 7% of its clients who have RMDs, failed to take them. The author of the article estimated exptrapolated its data across the entire U.S. population and estimated that the IRS penalties due will be between $680 milliion and $1.7 billion.

Each year, Financial Planning Hawaii encourages clients who are over age 73 or who have inherited IRAs to take their RMDs earlier in the year so as not to forget at year-end. Alicia and Sue have already begun reaching out.

NOTE: IRA holders may consolidate the RMD from multiple IRA accounts. However, consumers age 73+ who have 401(k) and/or 403(b) accounts from former employers, must take RMDs from each plan account.

Financial Planning Hawaii has the RMD amounts for all clients, but if you wish to check our math or have held away retirement accounts that are beyond our scope, here are hand links you can use to run your own numbers.

CHARLES SCHWAB CALCULATE YOUR RMD

CHARLES SCHWAB INHERITED IRA RMD CALCULATOR

John H. Robinson is the founder of Financial Planning Hawaii and Fee-Only Planning Hawaii and a co-founder of retirement simulation software-maker, Nest Egg Guru.

Although representatives of Financial Planning Hawaii may review client tax and legal documents, deliver tax-reporting documents, and raise awareness of potential tax and/or estate planning related mistakes or opportunities, none of this information should be construed as constituting specific tax or legal advice. All clients are encouraged to consult with their respective CPAs and/or attorneys for such guidance.