If I gift my kid more than $19,000, how much tax will be due and who owes it?

By John H. Robinson, Financial Planner (February 2026)

Common gifting questions such as the one posed in the title of this article serve to illustrate just how poorly misunderstood gifting rules are. All too often, tax planning misconceptions cause people to avoid giving money to help their children or grandchildren at the time of their greatest need. I am on a crusade to clear up these misconceptions and to help Financial Planning Hawaii and Fee-Only Planning Hawaii clients make sound, informed decisions about whether and how much to gift to family members and friends without having to worry about dear Uncle Sam’s share.

First, the Basics – IRS Gifting Rules Everyone Should Know

Annual Gift Tax Exclusion amount (2026) = $19,000 per person ($38,000 per couple). This is the maximum amount of money any person can give to any number of people without reducing the donor’s lifetime gift tax exclusion limit within a tax/calendar year.

Unified Gift & Estate Tax Exclusion Amount (2026) = $15,000,000 per individual ($30,000 per married couple). This is the cumulative amount each person can gift in their lifetime (over and above gifts less than or equal to the gift tax exclusion limit) before any federal estate tax is due. If no gifts larger than the annual gift tax exclusion amount have been recorded, then this $15,000,000 figure is also the total amount of a person’s estate that will be excluded from the federal estate tax calculation. Hence, the use of the term “unified.” The exclusion amount is adjusted annually for inflation.

IRS Form 709 – This is the form that a taxpayer is required to submit to document gifts over the current $19,000 gift tax exclusion amount. The amount recorded on the form reduces the lifetime $15,000,000 exclusion amount on a dollar-for-dollar basis.

About Form 709, United States Gift Tax Return (IRS.gov)

The Source of Confusion – Taxable Does Not Mean Tax Payment Due

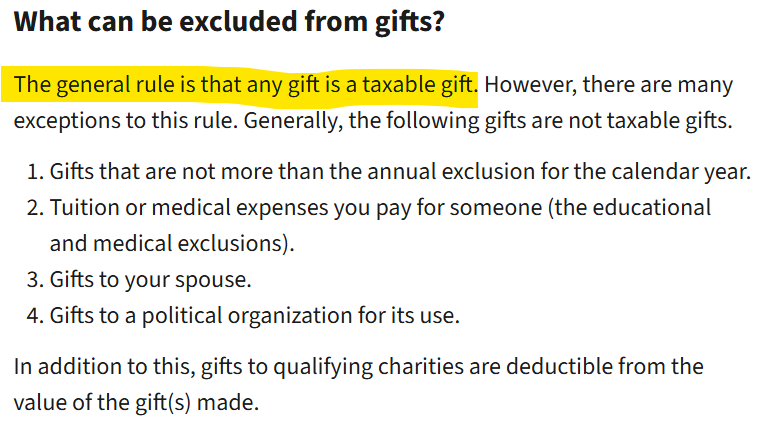

As you can see from the rules above, there appears to be considerable room for making substantial gifts without any tax being owed. In my experience, most consumers understand annual gift exclusion rule. However, most consumers have heard or read that gifts in excess of this amount are taxable, and that is 100% correct. A quick check on the IRS website finds the following quote –

The misconception lies in the fact that just because a gift is taxable, does not mean that any tax is owed. To illustrate this by analogy, if a married couple has $30,000 in gross income in 2026, they may not owe any income tax because the standard deduction is $32,000. Their income was still taxable and reportable, but no federal income tax may be due.

Similarly, if a married couple wants to give their son or daughter $300,000 to help purchase a house, the gift is taxable and must be reported on IRS Form 709. However, assuming the couple have not previously used up their $30,000,000 lifetime gift tax exclusion, NO TAX WILL BE OWED.

Practical Implications

To help dispel the misconceptions about gift and estate tax once and for all, here are other examples of common gifting questions I have fielded over the past four decades.

My husband and I want to help our children with private school tuition for our grandkids, are we capped at the $19,000 ($38,000) gift tax exclusion limit?

No. Per the IRS excerpt above, as long as you make the payment directly to the institution there is no limit. What’s more is that you could make separate $19,000 (each) annual gifts to your children and/or grandchildren on top of that amount, all without ever having to file IRS Form 709.

NOTE: The tuition exclusion is for tuition only. It does not carry over to books, student fees, room & board, or travel.

FAQs on the Use of the Gift Tax Medical and Tuition Expense Exclusion (Arent Fox Schiff AAL)

We have family overseas who could use our financial assistance, can we help them now without incurring any tax liability?

Yes. As per above, if assistance is for paying for tuition, there is no exclusion limit as long as the institution meets the IRS definition of an educational organization and as long as the payment is made directly to the institution. Additionally, each spouse could give up to $19,000 each to as many family members as you wish each year without using up any of your lifetime gift exclusion amount.

My best friend needs expensive surgery (over $100,000) that is not covered by her medical insurance, can I give her the money to pay for it?

The best answer to this is, “You should pay for the surgery directly rather than give the money to her, since there is no exclusion limit on qualifying medical expenses.” If you give her the $100,000 directly, you would be required file IRS Form 709.

NOTE: Cosmetic surgery, except to correct a birth defect or disfigurement from an accident or disease, generally does not qualify for the medical exepense exclusion.

My adult children will inherit my estate when I die, but they are having a tough time making ends meet now. Can I give them $100,000 each to help them get out of debt without them or me having to pay tax on the gift?

YES, YES, YES! Assuming you have not used your lifetime $15,000,000 gift exclusion, your gift will be taxable, and therefore must be reported on IRS form 709, but neither you nor your children will owe any tax.

NOTE: In those rare instances when wealthy donors have used up their lifetime gift exemption, it is the donor (or the donor’s estate) that owes the tax, not the donee/recipient.

Estate Tax: Tax rates, how it works, and who pays (Bankrate.com)

Conclusion: The Best Time to Give Is When the People You Care About Need It Most

The last question above is the primary motivation for writing this article. I cannot tell you how many times I have seen people balk at gifting out fear of the tax consequences. Nearly all of the people for whom I work have net worth’s that are far below the federaal lifetime exclusion amounts. In my experience, it is so much more appreciated when gifts are made to children when they are financially stressed and it is rewarding for the parents to be able to see the difference they are able to make in their children’s happiness.

Before wrapping this up, there are a couple of gifting pitfalls to keep in mind. Gifting appreciated assets such as a house, is often a sub-optimal idea because the cost basis is transferred to the donee(s). If the house is passed on to heirs up on death, it will generally receive a step up in basis. The same is true for appreciated stock.

Lastly, it is important to understand that this article has been about enhancing consumer understanding of federal gift and estate tax laws. Readers should keep in mind that some states have their own gift and estate rules.

ADDENDUM – The IRS Federal Estate and Gift Tax Table