This article suggests that the threat posed by the rapid evolution of AI and the pending introduction of digital human financial planner avatars, may be

Read More

This article presents an overview of potentail solutions for fixing Social Security, their potential impacts, and where Democrats and Republicans find common

Read More

Mortgage recasting is a strategy that allows homeowners to lower their monthly mortgage payments without refinancing their loan.

Read More

Charitable gift annuities (CGAs) offer a unique opportunity to support philanthropic causes while securing lifetime income and optimizing tax outcomes

Read More

The interplay between Social Security benefits and Roth IRA conversions is a critical topic for retirement planning.

Read More

Research and expert consensus increasingly support the idea that a small number of broad ETFs is not only sufficient but often optimal for most investors.

Read More

Investors are asking how they should react to the Trump-induced stock market decline. The time to prepare for downturns is BEFORE they happen.

Read More

This article sorts through the AI hype to provide readers with a useful framework for deciding if and how to invest in AI

Read More

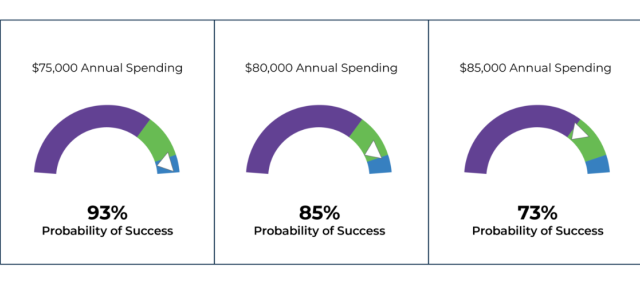

Criticism of Monte Carlo software that uses capital markets assumptions to produce "Probabilities of Success" is mounting.

Read More

This article shares the low-hanging fruit and also addresses the 800 lb stock market gorilla in the room.

Read More

This article includes links to Schwab's tax documents availability calendar, 2024 Supplemental tax info for money funds, RMD calculator, tax tables, and more.

Read More

This article raises awareness of the importance of reporting the portion of interest paid from government money funds that is state tax-free.

Read More