Use this checklist to make sure you customized preferences mapped over from TD Ameritrade.

Read More

Schwab's account verification process would make Dwight Schrute proud!

Read More

Buying CDs in an investment advisory account may have significant advantages over purchasing through your local bank.

Read More

The truth is out - Schwab's integration of TD Ameritrade was not the "boring snoozefest" that Schwab's PR machine reported.

Read More

Charles Schwab talks a big game about commission-free trading but charges clients $45 to trade Vanguard Funds.

Read More

How to access TD and Schwab statements, set account nicknames, and grant/receive viewing access.

Read More

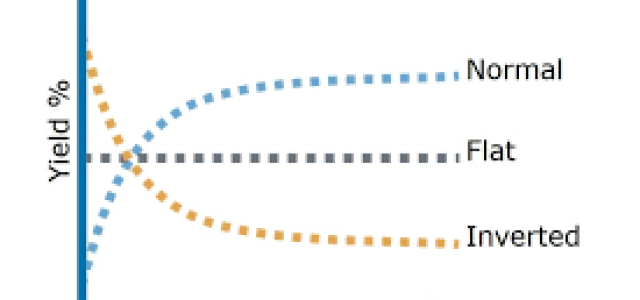

Time to buy bond funds? The answer is still "NO."

Read More

Until AI can learn to think critically and write satire, this financial planner does not feel threatened.

Read More

Financial Planning magazine called the TD-Schwab transition a "snoozefest." I haven't slept in two nights.

Read More

What's not to love about 6%, state-tax free, with implicit backing by the treasury? - Call Risk

Read More

Rock-Star Academic Researchers with Conflicted Interests Say You Should Buy Index Annuities. Should You?

Read More

A famous line from Shakespeare's Henry IV is applicable to portfolio management.

Read More