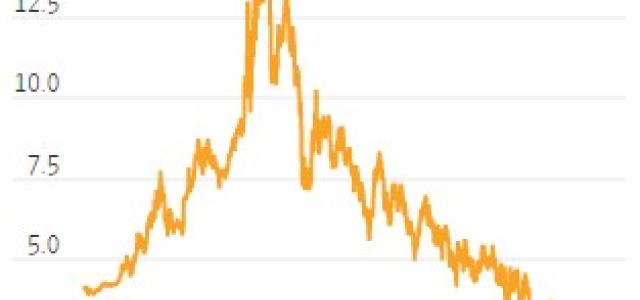

With fixed income yields near zero for the past two years, there has been little incentive to lock in rates on CDs and bonds, but rates they-are-a-rising!

Read More

Why we have stopped contacting clients to schedule financial planning reviews. (Yes, we still love you)

Read More

The stock market is decidedly not an ephemeral concept, and you don’t need tea leaves or tarot cards, or even an algorithm to invest successfully.

Read More

Q. How should we react to the stock market's decline? - A. Far better to plan for declines before they happen than to react to them when they occur.

Read More

The steady decline in interest rates over the last 40 years has produced an almost uninterrupted bull market in bonds. Unfortunately for investors, the gravy

Read More

A nightmare - Your 18-year old child has been in an accident and your access to information and ability to participate in medical decisions is restricted...

Read More

At Financial Planning Hawaii we take maintaining client data security very seriously...Yet for all money and effort we expend.

Read More

Beginning with the 2023-2024 school year, the new FAFSA will have 2/3 fewer questions. What's not to love about simplification?

Read More

The U.S. Treasury is paying 7.12% annualized on Series I Savings Bonds for the six-month period ending in May 2022. So, what's the catch?

Read More

2022 Tax Rule Changes - Mostly minor, but definitely one notable one for small business owners.

Read More

Kaka'ako does not show up in many Hawaii travel guides but it is one of the coolest places to hang out in Honolulu.

Read More

For most of the past 40 years, investors in intermediate and long-term bonds and bond mutual funds have profited as falling interest rates pushed the values of

Read More