The 2022 trainwreck in bond mutual funds was entirely avoidable. Financial Planning Hawaii founder John Robinson shows how obvious it was and how dangerous it

Read More

Keeping up with - or even ahead of - inflation may be attainable with these three investments.

Read More

If you are behind in saving for retirement, let’s hope the stock market goes down.

Read More

The Lifetime Income for Employees Act will be Harmful to 401(k) Plan Participants. Our latest research paper shows how life annuities purchased at retirement

Read More

This article seeks to change consumer perceptions about downturns in the stock market. Far from being foreboding, they are natural and provide investment

Read More

2022 has produced a bear market in everything. This article is a guide for investing when all asset classes are trending lower.

Read More

At this time there is a bear market in just about everything - stock, bonds, real estate, cryptocurrency, etc. are all trending lower. This article explains

Read More

Our latest research paper challenges the wisdom of annuitizing 401(k) and IRA savings at retirement and questions the value of mortality credits for retirees in

Read More

President Ronald Reagan once quipped that the 9 most terrifying words in the English language are, "I am from the government, and I am here to help."

Read More

This article offers refreshingly clear, unambiguous critical thinking that addresses consumers' greatest concerns about the current investment climate.

Read More

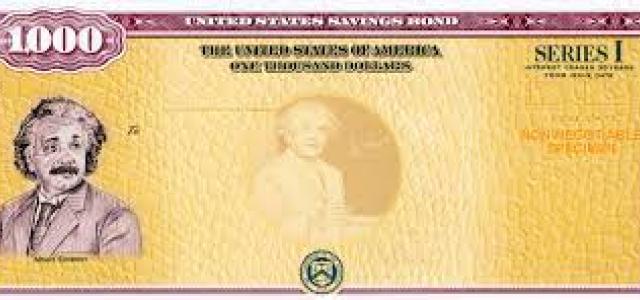

Series I Savings Bonds are offering a unique opportunity to earn 8% with a government guarantee, but you need to act fast to lock in the rate.

Read More

Financial Planning Hawaii has divided itself into three separate businesses each with its own website to position the company to truly be a multigenerational

Read More