Yield Shopper

This is a new service to Financial Planning Hawaii clients. Its purpose is to keep you apprised about the general level of interest rates on various fixed income investments, including money market mutual funds, bank money market and savings accounts, certificates of deposit (CDs), treasury and agency securities, municipal and corporate bonds, short-duration bond ETFs, and multi-year guaranteed annuity contracts (MYGAs). Nothing in this post is intended to be a specific recommendation to buy or sell anything. I am in the advice business, not the product sales business. To help make sense of this data, I will include my “two-cents” commentary at the bottom of this page. I plan to include this communication in every newsletter and I intend to deliver it separately via email in the months between issues.

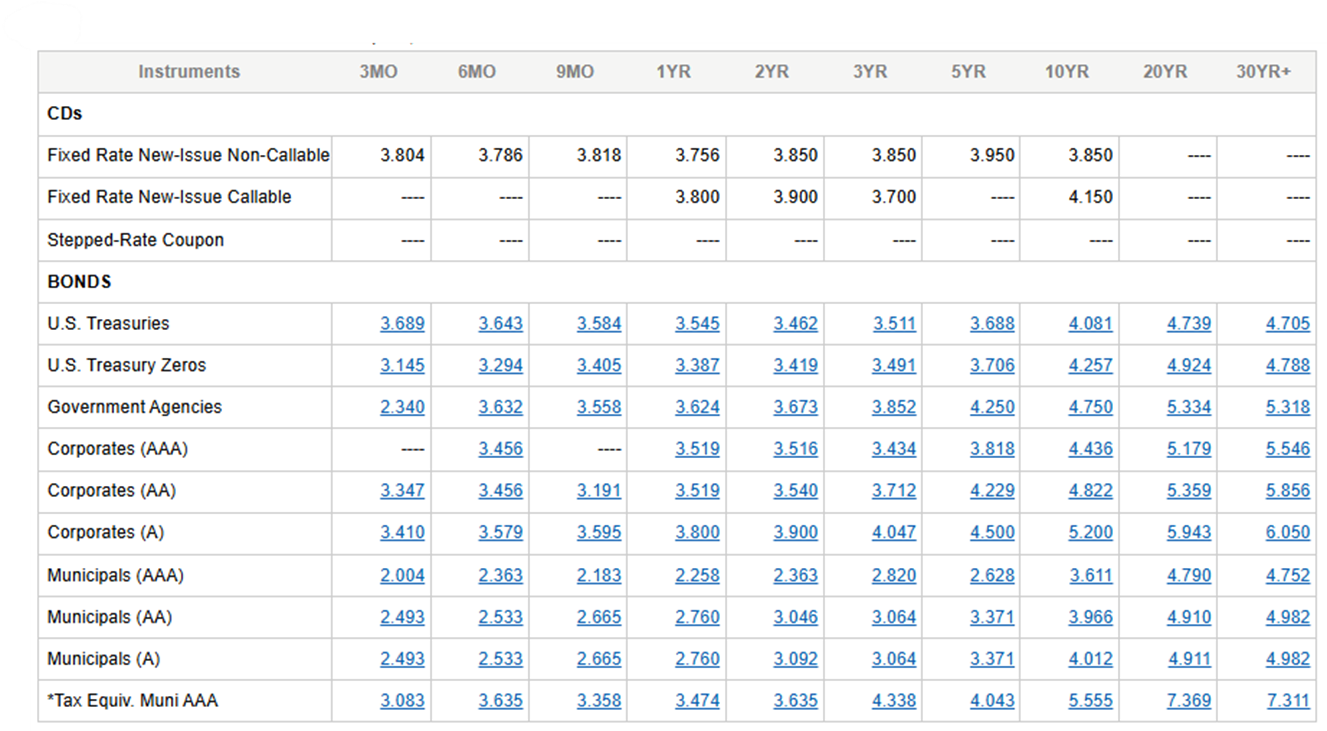

Source: Charles Schwab fixed income trading desk.

*The Taxable Equivalent Municipal AAA Yield is calculated from the Municipal AAA Yield, and assumes a 35% federal tax rate. This does not reflect the effects of any state or local taxes, which, if applicable, may increase the taxable equivalent yield. For questions about calculating your individual rate, see your tax advisor. The following formula is used: Taxable Equivalent Municipal Yield = (Municipal AAA Yield) / (1.00 - 0.35).

In reviewing the yields in the table above, investors should keep in mind that the interest paid on treasury securities and certain government agencies (e.g. Federal Home Loan Bank , Federal Farm Credit Bank, and Tennessee Valley Authority) is exempt from state income tax. Interest from most (but not all) municipal bonds is exempt from federal income tax. Federally tax exempt municipal bonds issued within your residence state (or issued by U.S. territories such as Guam and Puerto Rico) are generally exempt from state income tax as well. Interest paid Certificates of Deposit, Corporate Bonds, and annuity contracts is subject to federal and state income tax. In comparing yields between these securities it may be necessary to calculate the tax-equivalent yield.

Taxable Equivalent Yield Calculator (Source: Fidelity)

Money Market Funds

Fund Name & Symbol | 7-Day Yield | Link to Fact Sheet & Prospectus |

Schwab Prime Money Market Fund (SWVXX) | 3.50% | |

Schwab U.S. Treasury Money Fund (SNSXX) | 3.38% | |

Schwab U.S. Treasury Money Fund (Ultra Shares) SUTXX | 3.53% | |

Fidelity Prime Money Market Fund (SPRXX) | 3.38% | |

Fidelity Treasury Only Money Fund (FDLXX) | 3.26% | |

Vanguard Cash Reserves Fed MMF (VMRXX) | 3.61% | |

Vanguard Treasury Money Fund (VUSXX) | 3.65% |

Cash & Cash-Like ETFs

Issuer | APY | Link to Fact Sheet & Prospectus |

Vanguard 0-3 Month T-Bill ETF (VBIL) | 3.54% | |

iShares 0-3 Month Treasury ETF (SGOV) | 3.54% | |

SPDR 1-3 Month T-Bill ETF (BIL) | 3.68% | |

Schwab Short Term U.S. Treas ETF (SCHO) | 3.53% |

High Yield Savings Account Rates (Source: Bankrate.com)

Bank | APY |

|

Openbank | 4.09% | |

Vio Bank | 4..03% | |

Peak Bank | 4.02% | |

Lending Club | 4.0% |

Sample Online Bank CD Rates (Source: Bankrate.com)

Bank | 6 month | 12 month | 3 Year | 5 year |

Marcus by Goldman Sachs | 4.05% |

|

|

|

E*Trade |

| 4.10% |

|

|

Sallie Mae |

|

| 3.95% |

|

Sallie Mae |

|

|

| 4.0% |

Sample Multi-Year Guaranty Annity Contracts (MYGAs) (Source: ImmediateAnnuities.com)

Insurance Company | A.M. Best Rating | 3 Year | 5 Year | 7 Year |

Symetra | A |

|

| 5.05% |

Nationwide Life | A+ |

| 5.05% |

|

Pacific Guardian Life | A | 4.60% |

|

|

* MYGAs typically offer a fixed rate for pre-determined time, similar to a CD. However, consumers should be aware that most annuity contracts carry a surrender penalty for early withdrawal. When considering MYGAs consumers should determine if the surrender penalty period is longer than the guarantee period and they should be aware of the terms for avoiding automatic renewal. Consumers should also be aware that MYGAs are insurance products and are not federally insured. MYGAs are only as safe as the insurance company that issues them. Financial Planning Hawaii does not offer or sell MYGAs and we receive no remuneration for featuring any insurance company, bank or brokerage firm products featured in this article.

JR’s Two Cents

In terms of the big picture, the yields in the Schwab table show that the yield curve is no longer inverted. That is to say that the yield rises as we extend maturities. While this is referred to as a “normal” yield curve, it is still flatter than the normal curve that you might find illustrated in an economics text book. In plain English, investors do not get rewarded much for tying their money up longer. The only reason for individual investors to lock in intermediate or long term interest rates would be if you believe interest rates are going to go lower.

Investors who make that bet should be aware that bond values rise and fall with interest rate changes and the price volatility increases as maturities are extended. For instance, a 1% rise in the interest rate on 30 year treasuries could be expected to cause the value of existing 30-year treasuries to decline by around 18%.

I do not believe rates will go significantly lower from current levels. I do believe there is a better than 50% chance that interest rates on bonds may be materially higher 3-5 years from now. As such, I am encouraging FPH clients to keep cash liquid in money market funds and to not extend beyond 1-2 years of fixed income invsestments. If interest rates begin rising, I will begin recommending that clients extend maturities and resume laddering bond maturities as we did in 2022.

Readers of my commentary know that I do not ever recommend bond mutual funds or ETFs (aside from money market ETFs). I have written many articles on this topic, which are included below. This position is also shared by retirement researcher and financial planning industry leader Wade Pfau, PhD, CFA. Links to Wade’s commentary on this topic are as follows:

3 Ways to Incorporate Bonds Into Your Retirement Strategy (Retirement Researcher)

Why Bond Funds Don’t Belong in Retirement Portfolios (Wade Pfau, Advisor Perspectives)

Laddering with Individual Bonds (Retirement Researcher)

JOHN ROBINSON’S RECENT COMMENTARY ON FIXED INCOME INVESTMENTS FROM THE FPH BLOG

Short-Term Laddered Bond ETFs vs. Short Term Bond Funds (9/25/2025)

Cash ETFs: The New “New Thing” in the Search for Yield and Safety? (9/25/2025)

Government Money Market Funds Are Not All The Same (2/9/2025)

Why I Always Say “Friends Don’t Let Friends Buy Bond Funds (4/1/2025)

Not So Hot TIPS (11/1/2024)

Keeping Score – A Running Record of My Interest Rate and Fixed Income Guidance Since 2020 (6/5/2024)

Where to Fish for the Best Fixed Income Yields Today (3/4/2024)

Interest Rates on CDs Plummeted in November. How to Invest Now (12/3/2023)

How to Invest When the Yield Curve is Inverted (9/8/2023)

It's Time to Start Laddering Certificates of Deposit Again (5/21/2023)

Is Your Cash Working as Hard as it Should Be? 2/16/2023

How to Invest in Bonds and CDs Now that Interest Rates Have Risen 12/10/2022

Where to Stash Cash Now 9/29/2022

I was Right About Interest Rates 9/29/2022

The Time to Buy Series I Savings Bonds is NOW! 4/18/2022

Why Friends Don’t Let Friends Buy Bond Funds (3/1/2022)

Saying that the Bull Market in Bonds is Over is NOT Market Timing 12/10/2021

Negative Returns Ain’t Much of a Living (8/9/2021)

Looking for Yield in All the Wrong Places (5/25/2021)

John H. Robinson is the founder of Financial Planning Hawaii and Fee-Only Planning Hawaii and a co-founder of retirement simulation software, Nest Egg Guru.

Financial Planning Hawaii is an SEC-Registered Investment Adviser (RIA). Registration as an investment adviser does not imply any level of skill or training. For verification of Financial Planning Hawaii's regulatory status, all website visitors are encouraged to visit the SEC Investor Advisor Public Disclosure website. The site allows you to search by firm name and by adviser name. It provides detailed information about the firm's business model and each investment adviser representative's professional experience, educational background, and disclosure history.

Financial Planning Hawaii's 2025 SEC Form ADV | Financial Planning Hawaii's 2025 Customer Relationship Summary